life insurance face amount vs death benefit

The exact face value of your. Its the amount of death benefit purchased which indicates the amount of money the policy will pay to the beneficiary or beneficiaries when the insured person dies.

:max_bytes(150000):strip_icc()/dotdash-life-vs-health-insurance-choosing-what-buy-Final-b6741f4fd8a3479b81d969f9ea2c9bb3.jpg)

Life Vs Health Insurance Choosing What To Buy

It also represents a literal savings that generates interest to hold down the future cost of mortality.

. Within your policy it is officially denoted as the death benefit. The concept of the death benefit is quite simple. A permanent life insurance policy has a face value also known as the death benefit.

This is because with the fully funded mini. Since it is clear that the face amount of the whole life policy is the death benefit or the original coverage the face amount is only paid after the policyholder dies. If you purchase a policy for 100000.

Ad Easy Online Application with No Medical Exam Required Just Health and Other Information. The initial amount of money claimed by the beneficiaries on account of. If you had a death benefit of 200000 with no loan and 50000 in the cash account your beneficiaries would be paid 200000 upon your death while the 50000 would.

First the death benefit associated with each mini policy will be much lower than what the insurance company promised for the base policy. The net amount at risk is the difference between the death benefit and the cash value. When the insured of an active insurance policy dies the insurance company has the obligation to pay out the face amount of insurance.

A structure of an increasing death benefit UL and cost will depend on the assumption of the target case value. This is often far more easily accomplished. As Low As 349 Mo.

Universal life insurance allows policy owners to rather easily make adjustments to the death benefit or face amount of their policies. You cant be turned down due to health. How much and a what age.

The face amount is the initial amount of money stated on the life insurance application when you first buy the policy and is intended to be paid as a death benefit to your. Exclusive AARP Member Benefit. Keep in mind that face amount and paid death benefits are similar.

Apply for guaranteed acceptance life insurance. Typical cash value targets will. See How Term Life Can Help Protect Your Familys Future.

A person typically purchases a life insurance policy to secure a death benefit made payable to the survivors of the insured once they are no longer living. All life insurance policies have a face amount which is also called the death benefit this is the amount thats paid to your beneficiaries after you die. The face value is typically how much your life insurance beneficiaries will receive if you die while your policy is in force.

On the other hand the face value represents the monetary value of the death benefit plus the value of any additional benefits you choose to add to your policy. Simply put the life insurance face value also called the death benefit is the amount that your beneficiary will receive when you die. Options start at 995 per month.

With this option your beneficiary receives the death benefit amount only and not also the cash. Face value can also be used synonymously with face amount or coverage amount. So if you buy a policy with a 500000 face value in most.

The death benefit is designed to stay level throughout the life of the policy. This is the dollar amount that the policy owners beneficiaries will receive upon the. At the beginning of the policy the face value and the death benefit are the same.

Ad No Medical Exam-Simple Application. 7 If you dont. Face Amount vs Death Benefit.

They both reflect the amount of money that the insurance company will pay out in the. Ad Get an instant personalized quote and apply online today. A death benefit can also be reduced by loans or partial.

Do not assume that the face amount is the same as the death benefit when it comes to permanent life insurance. But only permanent life. The stated dollar amount that the policys beneficiaries receive upon the death of the insured1 In some cases the face value of the life insurance policy may be the most.

/dotdash-ask-answers-205-Final-7a1ca51b85d44e0d81dc7b46f919180d.jpg)

Term Vs Universal Life Insurance What S The Difference

What Is Whole Life Insurance And How Does It Work Lincoln Heritage

Pin On Insurance Marketing Humor Estate Planning Chronic Critical Illness Annuities Tax Savvy Make Money

Whole Life Insurance Life Insurance Glossary Definition Sproutt

What Are Paid Up Additions Pua In Life Insurance

Paid Up Additions Work Magic In A Bank On Yourself Plan

5 Things You Didn T Know Life Insurance Could Do Life Insurance Quotes Life Insurance Facts Life Insurance

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

Pin On Outline Financial Infographic

Life Insurance Vs Annuity How To Choose What S Right For You

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

The Risk Of Surviving To Policy Maturity What Trustees Need To Know Ric Omaha

Annuity Vs Life Insurance Similar Contracts Different Goals

Cash Value And Cash Surrender Value Explained Life Insurance

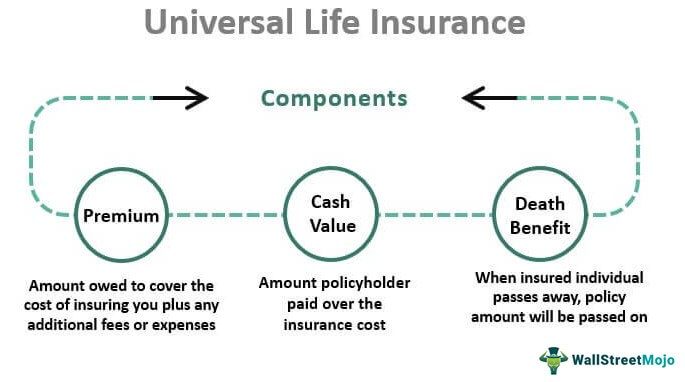

Universal Life Insurance Definition Explanation Pros Cons

/dotdash-090816-cash-value-vs-surrender-value-what-difference-final-b2df392375e34caf9eac4e7bc2648283.jpg)

Cash Value Vs Surrender Value What S The Difference

Life Insurance Loans A Risky Way To Bank On Yourself

Cash Value Life Insurance Life Insurance Life Insurance Agent Insurance Policy